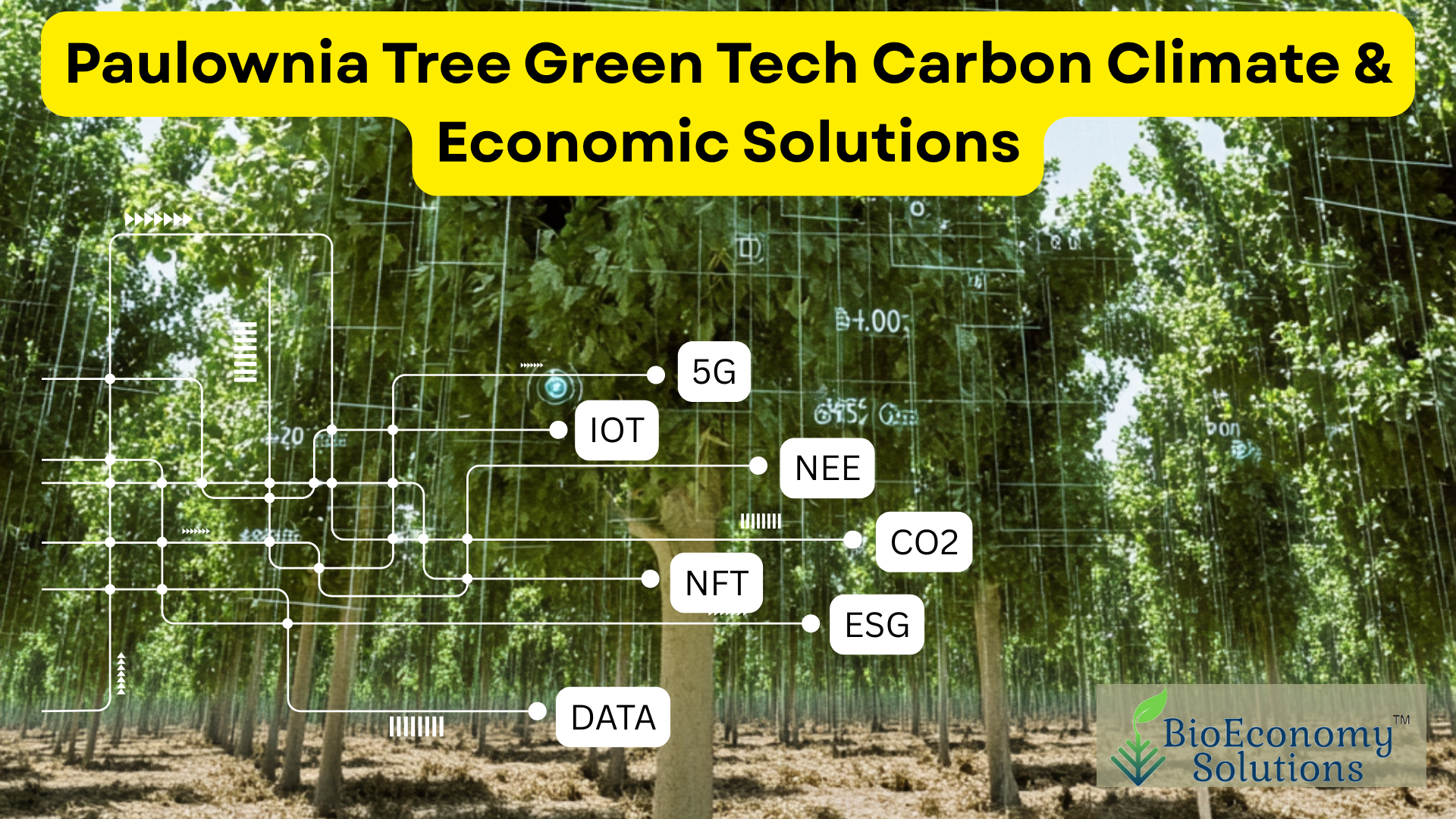

When considering Paulownia Tree Tokenizing Real-World Tree Assets. The Paulownia tree, known for its rapid growth, carbon absorption capacity, and economic value, is an ideal candidate for tree tokenization — a growing trend in climate tech and green finance. Here’s how Paulownia trees can be utilized within the tokenization framework to support environmental, economic, and social goals.

Tokenization of Paulownia Trees: How It Works and Why It Matters

What is Tokenization in this Context?

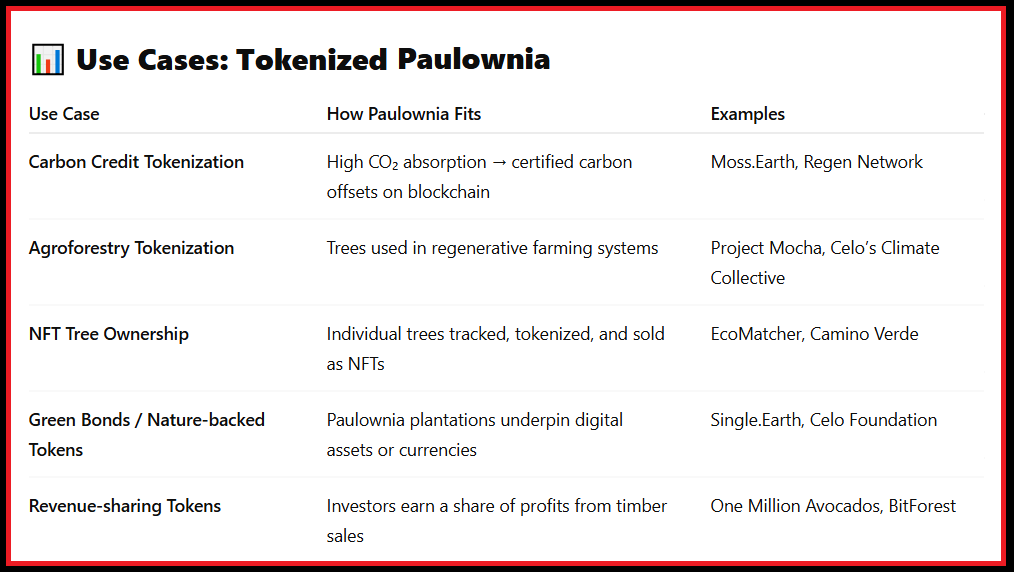

Tokenization involves converting ownership rights, carbon capture value, or economic benefits of a Paulownia tree (or a plot of them) into digital tokens on a blockchain. These tokens can be:

- Sold or traded

- Tracked transparently

- Linked to real-world metrics like carbon sequestration or timber value

Why Paulownia is an Ideal Tree for Tokenization

1. High Carbon Sequestration

- Paulownia trees absorb 10–20 times more CO₂ than many other tree species.

- Their fast growth rate (up to 3–5 meters per year) means quicker and measurable carbon credit generation.

- This makes them excellent for carbon offset tokens like those issued by other platforms.

2. Economic Value

- The wood is lightweight, strong, and highly valuable in industries such as furniture, construction, and musical instruments.

- Paulownia-based tokens can represent timber futures, making them attractive to investors — similar to the One Million Avocados or Project Mocha model.

3. Reforestation and Regenerative Agriculture

- Paulownia trees can be used in reforestation and agroforestry, contributing to climate resilience and land restoration goals.

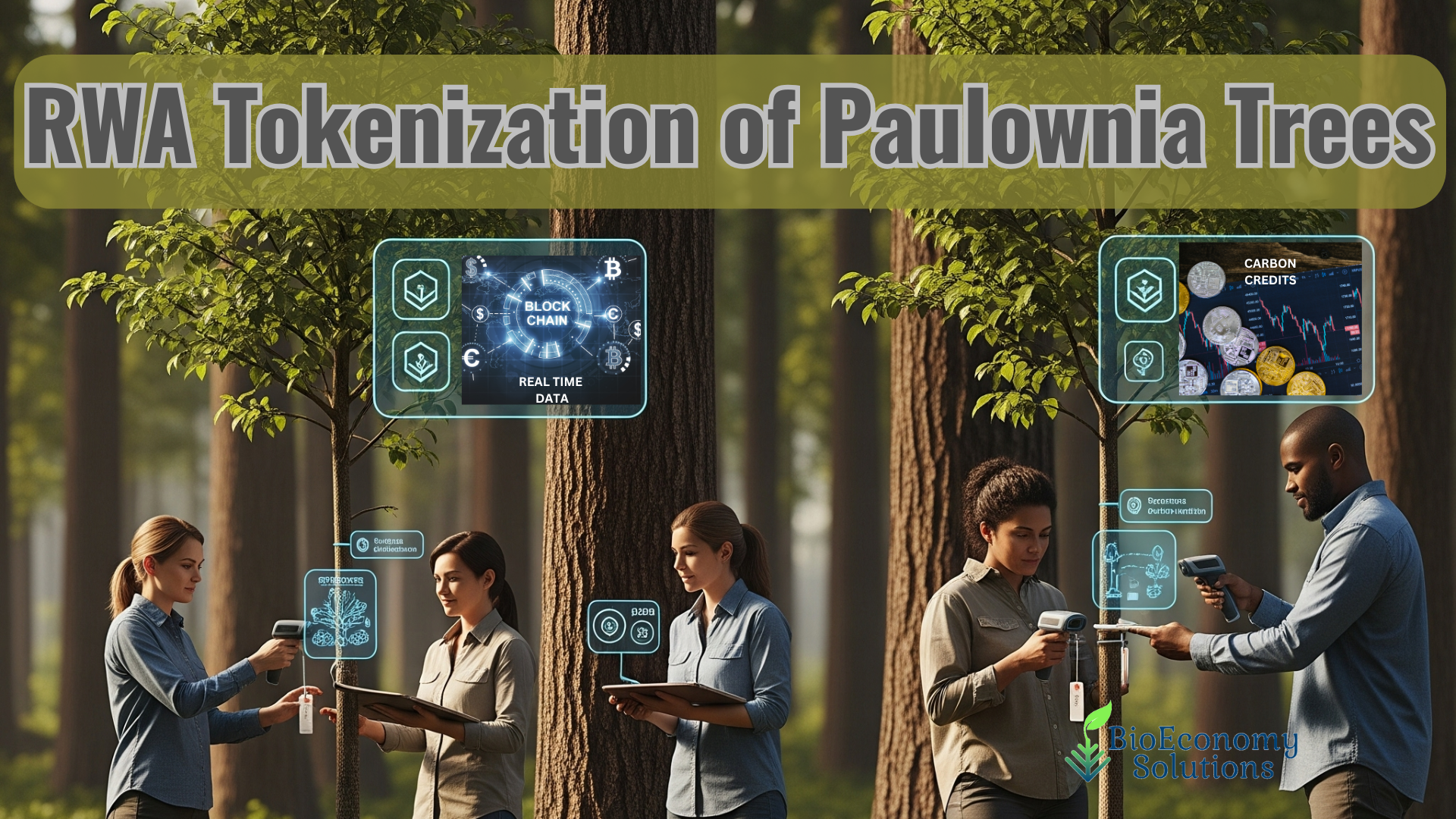

- Like EcoMatcher or Camino Verde, projects can tokenize individual Paulownia trees using GPS tracking, growth data, and QR codes for transparency.

4. Shorter ROI Cycle

- Due to their fast maturity (harvestable in 5–7 years), investors see returns sooner than with slow-growing trees.

- This reduces risk and increases appeal for retail and institutional investors alike.

🔒 Benefits of Tokenizing Paulownia

✅ For Farmers: Upfront capital through token sales, improved livelihoods

✅ For Investors: Access to verified green assets, carbon offsets, or timber revenues

✅ For the Planet: Encourages tree planting, land restoration, and sustainable land use

✅ For Regulators: Easier monitoring and verification via immutable blockchain data

Strategic Path Forward

BioEconomy Solutions built a Paulownia tokenization platform by:

Partnering with forestry experts to establish high-quality plantations.

Working with carbon certifiers (like Net Eco Exchange, Verra or Gold Standard) to validate carbon offset.

Tokenizing assets using platforms like Polygon, Celo, or Ethereum.

Selling tokens to corporations, ESG investors, or climate-conscious individuals.

Today’s Real World Asset – Paulownia Trees

The Paulownia tree, thanks to its biological, economic, and environmental strengths, is perfectly suited for the tokenized future of forestry. By converting its carbon, growth, and timber value into blockchain-based tokens, Paulownia can help create a transparent, inclusive, and sustainable financial model that aligns with the goals of the UNCCD, Paris Agreement, and global reforestation efforts.

Contact Us

Where To Buy Paulownia Core Materials? QUESTIONS?

Visit our web page. https://bioeconomysolutions.com/paulownia-lumber/

What is paulownia wood? https://bioeconomysolutions.com/what-is-paulownia-wood/

We’re happy to organize a time to speak with you about our paulownia trees and lumber we have for sale. Please book your preferred time to speak directly.

Here’s a link to my online calendar/schedule:

www.bioeconomysolutions.com/bookcall

BioEconomy Solutions

Office: 843.305.4777

Visit us at: https://bioeconomysolutions.com/paulownia-carbon-credits/ Let’s chat about paulownia tree solutions for sustainable Forest carbon credits projects.

LIKE|SHARE|COMMENT